No. 1 Credit Summit in the Nation

October 11-13, 2024

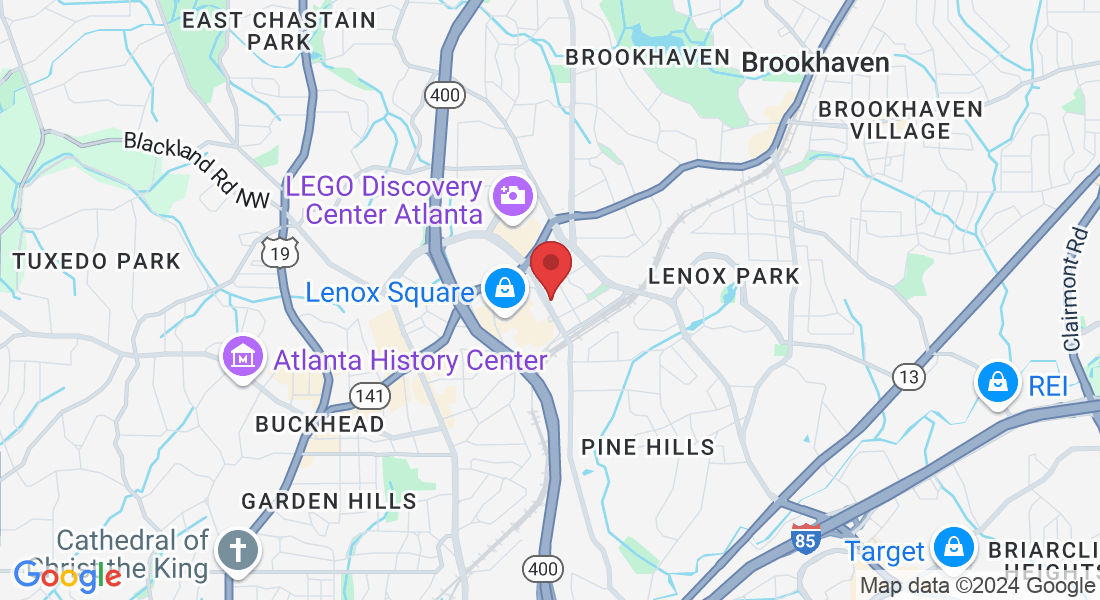

Marriott Buckhead Hotel & Conference Center Atlanta, GA

No. 1 Credit Summit

in the Nation

October 11-13, 2024

Marriott Buckhead Hotel & Conference Center Atlanta, GA

JOIN US FOR THE GREATEST CREDIT SUMMIT

Industry titan Daraine Delevante and a lineup of top experts will be at the nation’s premier event for consumers and credit repair professionals. Learn how to erase negative items from your credit report—bankruptcies, late payments, charge-offs, inquiries, student loans, and collections. Master financial literacy, turn bad credit into cash, and equip yourself, your friends, and your family with the strategies for lasting financial success.

Don’t miss this opportunity—transform your credit and your future!

WHY YOU NEED TO BE AT

THE CREDIT SUMMIT?

Dominate Your Credit and Live Life on Your Terms

Streamlined Learning Experience

Turbocharge Your Credit, Finances and Life

Dominate Your Credit and Live Life on Your Terms

Unmatched Networking Opportunities

THE NATION'S FIRST CREDIT EDUCATION

EVENT, EMBRACE CHANGE, ACHIEVE

FINANCIAL FREEDOM & PROSPERITY!

Join The #1 Credit Summit In The Nation , Bringing Together Credit Professionals & Consumers For a 3-Days Event Packed With Industry Strategies & Tactics To;

Erase Your

Credit Worries

Empower You to

Unlock Financial

Opportunities

Elevate Your

Credit Score

THE NATION'S FIRST CREDIT EDUCATION

EVENT, EMBRACE CHANGE, ACHIEVE

FINANCIAL FREEDOM & PROSPERITY!

Join The #1 Credit Summit In The Nation , Bringing Together Credit Professionals & Consumers For a 3-Days Event Packed With Industry Strategies & Tactics To;

Erase Your

Credit Worries

Empower You to

Unlock Financial

Opportunities

Elevate Your

Credit Score

The Credit Summit Agenda

Get Ready to learn the Truth About Credit , Leverage Credit & Change your life!

DAY 1

5:30 pm - 8:00 pm

VIP & Mentees Registration

We will require your VIP/Mentee wristbands to enter the venue.

6:00 pm - 10:00 pm

VIP & Mentees Meet & Greet Mixer Event

DAY 2

8:00 am - 9:00 am

Registration & Coffee

Registration & Coffee Time

9:00 am - 9:20 am

The Credit Summit - Why are you here?

A Catch Box participation exercise to welcome everyone to The Credit Summit! We are thrilled to have you with us today as we dive into the world of credit, financial empowerment, and transformative change. But before we begin, we want to hear from you! Let's kick off our event with a fun and engaging participation exercise that puts you at the center of our conversation. Why Are You Here? It's a simple question, but one that can have a variety of powerful answers. Are you here to learn how to improve your credit score? To discover strategies to grow your business? Or maybe you're looking to network with like-minded professionals? Whatever your reason, we want to know! Here's how it works: Catch the Box: We'll be tossing around a Catch Box—a fun, soft microphone that makes audience interaction easy and exciting. When you catch the box, take a moment to introduce yourself to the room. Share Your Reason: Tell us why you're here at The Credit Summit. What do you hope to gain from this experience? What questions are you looking to get answered? Share your motivations, goals, or even your biggest credit challenges. Pass It On: Once you've shared, pass the Catch Box to someone else. Let's keep the conversation flowing and get to know the diverse reasons that brought each of us to this summit. This exercise is not just about introductions; it's about creating connections and setting the stage for meaningful discussions throughout the day. Your participation helps us shape the conversations and ensures that our sessions meet your needs and expectations. So, get ready to catch the box, share your story, and make the most of your time here at The Credit Summit! Let's find out together—Why are you here?

9:20 am - 9:30 am

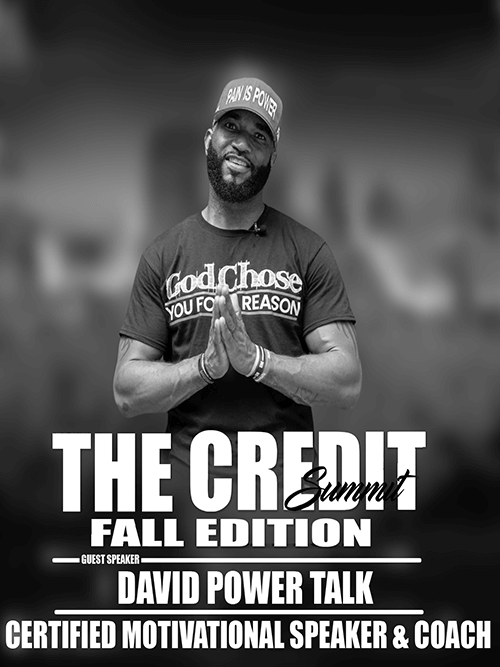

Mindset: Breakthrough Your Limited Beliefs

Are You Ready to Break Through Your Limiting Beliefs? Join us for an empowering and transformative session with motivational speaker David "Powertalk" Solomon! In this high-energy event, we will dive deep into the world of mindset and uncover the hidden beliefs that hold you back from reaching your full potential. What You Can Expect: Identify Your Limiting Beliefs: Discover the subconscious thoughts and beliefs that are keeping you from achieving your goals. David will guide you through exercises and discussions that will help you identify what’s holding you back. Reprogram Your Mindset: Learn proven techniques to shift your mindset from one of limitation to one of possibility and abundance. David's powerful insights and practical strategies will provide you with the tools to start changing your thought patterns immediately. Empowerment Through Action: David believes that real change happens through action. You'll leave this session not only inspired but with a clear action plan to break free from your limiting beliefs and start living the life you truly want. Interactive and Engaging: Get ready to participate! David’s sessions are known for their interactive nature. Be prepared to engage in thought-provoking activities, share your insights, and connect with others who are on the same journey of personal growth. About David "Powertalk" Solomon: David Solomon, known as "Powertalk" for his dynamic and engaging speaking style, is a renowned motivational speaker and mindset coach. With years of experience helping individuals and organizations achieve breakthrough success, David's passion for personal development is contagious. His mission is to empower you to realize your own potential and live your best life. Don’t miss this opportunity to transform your mindset and break through the barriers that have been holding you back. Join us for this powerful session with David "Powertalk" Solomon and take the first step towards your breakthrough!

9:30 am - 10:00 am

Pulling Credit Reports - How To Read Your Credit Report & Identify Negative items

Are You Ready to Take Control of Your Credit? Understanding your credit report is a crucial step towards achieving financial stability and improving your credit score. Join us for this informative and practical session on "Pulling Credit Reports: How to Read Your Credit Report & Identify Negative Items" and learn how to navigate the complex world of credit reports with ease. What You'll Learn: How to Pull Your Credit Report: Learn the steps to access your credit report from major credit bureaus. We will guide you on how to request your report, understand your rights, and how often you can access it for free. Decoding Your Credit Report: Credit reports can be confusing with all the numbers, codes, and terminology. We'll break down each section of the report, explain what everything means, and show you how to make sense of the information presented. Identifying Negative Items: Negative items like late payments, collections, and charge-offs can significantly impact your credit score. We will teach you how to spot these items quickly, understand their implications, and assess their accuracy. Understanding the Impact of Negative Items: Discover how different negative items affect your credit score and your overall financial health. Learn why it's essential to address these issues and how they can affect your ability to get loans, credit cards, or even rent an apartment. Steps to Dispute Inaccurate Information: Find out how to take action if you spot errors or inaccuracies in your credit report. We'll provide you with the tools and knowledge to dispute incorrect information effectively and ensure your credit report accurately reflects your financial behavior. Who Should Attend: This session is ideal for anyone looking to gain a deeper understanding of their credit report, whether you're new to managing credit or looking to repair and improve your existing credit score. Financial professionals, students, and anyone interested in personal finance will find valuable insights and actionable advice. Why Attend? Empower yourself with the knowledge to take control of your credit. Gain confidence in managing and improving your credit score. Learn from Daraine Delevante who can answer your questions and provide support. Take the first step towards better credit management! Join us for this essential session and equip yourself with the tools and knowledge you need to navigate your credit report and tackle negative items head-on.

10:30 am - 11:00 am

Breaking down the 5 Factors of Credit & Leveraging Consumer Law for Deletions

Ready to Unlock the Secrets of Your Credit Score? Understanding your credit score is essential for taking control of your financial future. Join us for this eye-opening session, "Breaking Down the 5 Factors of Credit & Leveraging Consumer Law for Deletions," where we'll dive deep into the factors that shape your credit score and reveal how you can use consumer laws to your advantage to improve it. What You'll Learn: The 5 Key Factors of Your Credit Score: We'll explore each of the five critical elements that influence your credit score: payment history, credit utilization, length of credit history, new credit, and credit mix. By understanding how each factor affects your score, you'll be better equipped to make informed decisions that can positively impact your credit profile. How to Improve Each Factor: Learn actionable strategies for boosting each of these credit factors. Whether it's reducing your credit utilization ratio or establishing a longer credit history, we'll provide practical tips to help you strengthen your credit score over time. Leveraging Consumer Law for Credit Repair: Many people don't realize that they have legal rights when it comes to their credit report. Discover how consumer protection laws, such as the Fair Credit Reporting Act (FCRA), can be used to challenge and remove inaccurate, outdated, or unverifiable information from your credit report. Steps to Dispute and Delete Negative Items: Learn how to initiate disputes with credit bureaus effectively. We'll guide you through the process of identifying errors, filing disputes, and following up to ensure that negative items are deleted from your credit report. Real-World Examples and Success Stories: Hear real-life examples of how individuals have successfully leveraged consumer law to clean up their credit reports and improve their scores. These success stories will inspire and motivate you to take control of your own credit situation. Who Should Attend: This session is perfect for anyone looking to understand how credit scores work and those interested in using legal means to clean up their credit reports. Whether you're new to credit, looking to repair your credit score, or a professional in the financial industry, this event offers valuable insights for everyone. Why Attend? Gain a clear understanding of what affects your credit score and how you can improve it. Learn about your rights under consumer law and how to use them to your benefit. Walk away with practical tools and strategies to clean up your credit report and boost your score. Don't miss this opportunity to take charge of your financial future! Join us for this essential session and empower yourself with the knowledge and tools to navigate the credit landscape with confidence.

11:30 am - 12:00 pm

Secrets To Getting Approval

Unlock the Keys to Financial Approval Success! Navigating the world of credit can often feel like trying to crack an elusive code. Join us for our dynamic session, "Secrets to Getting Approval," where we will demystify the approval process and equip you with the strategies you need to secure credit, loans, and other financial products with ease. What You’ll Learn: Understanding the Approval Criteria: Learn what lenders and credit providers are really looking for when they assess your application. We’ll dive into the criteria that matter most, including credit score, income, debt-to-income ratio, and other key factors that influence approval decisions. Building a Strong Credit Profile: Discover actionable tips to build and maintain a solid credit profile. We’ll explore the importance of a healthy credit mix, payment history, and how to strategically manage credit inquiries to boost your chances of approval. The Power of Credit Utilization: Learn how to effectively manage your credit utilization ratio to present yourself as a responsible borrower. Understand why keeping your credit card balances low can make a big difference when seeking approval. Mastering the Application Process: Get insider tips on how to fill out credit applications effectively, what to include, what to avoid, and how to present your information in the best possible light to increase your likelihood of approval. Leveraging Pre-Approval Offers: Understand the benefits of pre-approval and how to use it as a tool to gauge your chances of approval before formally applying. We’ll discuss how pre-approval can save you time and protect your credit score. How to Handle Rejections and Turn Them Into Approvals: If you’ve been denied credit in the past, don’t worry—we’ll show you how to turn that "no" into a "yes." Learn how to read and respond to denial letters, improve your credit profile, and reapply successfully. Tips for Specific Credit Types: Whether you’re looking for a mortgage, auto loan, personal loan, or credit card, we’ll provide tailored advice to help you navigate the specific approval requirements of each credit type. Who Should Attend: This session is perfect for anyone seeking to improve their chances of getting approved for credit or loans. Whether you’re a first-time borrower, someone looking to rebuild your credit, or a financial professional wanting to assist clients, this session will provide valuable insights and strategies. Why Attend? Gain the knowledge you need to understand what lenders are looking for. Learn actionable steps to strengthen your credit profile and improve your approval odds. Empower yourself with the tools and techniques to navigate the credit landscape with confidence. Don’t leave your financial future to chance! Join us and uncover the secrets to getting approval, and take control of your financial journey today.

11:00 am - 11:30 am

Credit Bureaus Don't Exist: Secondary Consumer Reporting Agencies

Discover the Hidden Players in Your Financial Profile! In the world of credit and consumer reporting, most people are familiar with the "Big Three" credit bureaus: Experian, Equifax, and TransUnion. However, did you know that there are numerous other agencies collecting, storing, and reporting your financial data? Join us for our eye-opening session, "Credit Bureaus Don’t Exist: Secondary Consumer Reporting Agencies," where we unveil the lesser-known but influential players in the credit reporting industry. What You’ll Learn: Unmasking the Secondary Agencies: Learn about the various secondary consumer reporting agencies that operate behind the scenes. Discover who they are, what data they collect, and how they can impact your creditworthiness and financial opportunities. How Secondary Agencies Affect You: Understand the role of these agencies in your everyday financial life. From rental history to medical records, utility payments to employment background checks, we’ll show you how secondary agencies have a far-reaching impact on your credit profile and financial decisions. Common Types of Secondary Reports: Get acquainted with the different types of consumer reports these agencies provide, including tenant screening reports, employment background checks, insurance claims history, check-writing history, and more. Knowing what reports are out there can help you stay one step ahead. Your Rights Under the Law: Empower yourself by learning about your rights under the Fair Credit Reporting Act (FCRA) and other relevant consumer protection laws. We’ll discuss your right to access, dispute, and correct information held by secondary reporting agencies. How to Monitor and Manage Secondary Reports: Learn practical steps to request and review your secondary reports. We’ll provide tips on how to identify and address errors, and how to take control of your data to protect your financial reputation. Strategies for Dealing with Negative Reports: Discover effective strategies for handling negative information on your secondary reports. We’ll discuss dispute processes, negotiation tactics, and how to work with these agencies to improve your standing. The Future of Consumer Reporting: Gain insights into emerging trends and technologies in the consumer reporting industry. Understand how data privacy concerns, regulatory changes, and innovations like artificial intelligence are shaping the future of credit reporting. Who Should Attend: This session is ideal for individuals looking to gain a deeper understanding of how their financial data is handled and reported. Whether you’re a consumer seeking to protect your credit, a financial advisor, a credit repair specialist, or a legal professional, this session will provide valuable knowledge and tools. Why Attend? Learn about the hidden agencies that play a critical role in your financial life. Understand your rights and how to protect your data. Discover how to manage and improve your consumer reports beyond the traditional credit bureaus. Don’t be in the dark about your financial data! Join us and learn how to navigate the world of secondary consumer reporting agencies, ensuring you’re fully informed and in control of your financial future.

10:00 am - 10:30 am

Making Money With Digital Products & Passive Income

Unlock the Secrets to Financial Freedom! In today’s fast-paced digital age, creating multiple streams of income isn’t just a luxury—it’s a necessity. Imagine making money while you sleep, earning profits from products you created once, and enjoying the flexibility of a lifestyle that allows you to work from anywhere. Join us for the "Making Money with Digital Products & Passive Income" event, where we dive deep into the world of digital entrepreneurship and passive income strategies. What You’ll Learn: Introduction to Digital Products: Discover what digital products are and why they are the perfect avenue for generating passive income. From e-books and online courses to printables and software, learn how digital products offer limitless opportunities for income generation. Creating Your First Digital Product: Learn the step-by-step process of brainstorming, creating, and launching a digital product. We’ll guide you through everything you need to know—from identifying a profitable niche to choosing the right platform to host your product. Passive Income Streams: Explore various passive income models beyond digital products. Learn about affiliate marketing, subscription services, membership sites, and more. Understand how to create a diversified portfolio of passive income streams that can sustain your financial future. Marketing Your Digital Products: Understand the importance of effective marketing to ensure your digital products reach the right audience. We’ll cover content marketing strategies, social media promotion, email marketing, and using paid ads to boost your visibility and sales. Automating Sales and Scaling Your Business: Discover tools and techniques to automate your sales process, from setting up a sales funnel to using email autoresponders. Learn how to scale your digital product business to maximize profits with minimal ongoing effort. Case Studies and Success Stories: Gain inspiration from real-life examples of successful entrepreneurs who have built thriving businesses with digital products and passive income. Learn from their experiences, mistakes, and triumphs. Legal and Financial Considerations: Get insights into the legal aspects of selling digital products, including copyright protection, terms and conditions, and GDPR compliance. Learn about managing finances, setting up payment gateways, and handling taxes. Who Should Attend: This event is perfect for aspiring entrepreneurs, freelancers, business owners, and anyone interested in creating an additional income stream. Whether you’re a seasoned professional looking to expand your business model or a beginner curious about digital products, this session will provide valuable insights and actionable strategies. Why Attend? Learn how to create and sell digital products for ongoing passive income. Understand the various passive income streams available and how to tap into them. Gain practical tips on marketing, automation, and scaling your digital business. Get inspired by success stories and learn how you can replicate their strategies. Take the first step towards financial freedom! Join us and learn how to leverage digital products and passive income to build a sustainable and lucrative business model. Embrace the potential of digital entrepreneurship and start making money on your terms!

12:00 pm - 1:30 pm

Lunch

Lunch Time

1:30 pm - 2:00 pm

Personal & Business Tax Strategies

Flame breaks down the credit system in a way that it is easy to digest.

2:00 pm - 2:30 pm

Child Support is Fraud

The truth behind the child support system is revealed, listen as Lionell "TJ" Tillman explains why child support is fraud.

2:30 pm - 3:00 pm

Leveraging Consumer Laws To Start Cash Flowing Businesses

Unlock the potential of consumer laws to kickstart and grow profitable businesses at our engaging event, Leveraging Consumer Laws To Start Cash Flowing Businesses. Designed for entrepreneurs, business owners, and legal professionals, this event will provide you with the knowledge and strategies needed to navigate and utilize consumer protection laws effectively to drive your business success. What to Expect: Expert Insights: Gain valuable perspectives from legal experts and successful entrepreneurs who will discuss how to leverage consumer laws to create and sustain profitable ventures. Learn about the legal frameworks that can be harnessed to protect your business and enhance consumer trust. Legal Fundamentals: Dive deep into the essential consumer laws that impact business operations, including regulations on advertising, privacy, product safety, and customer rights. Understand how these laws can be used strategically to your advantage. Practical Workshops: Participate in interactive sessions that offer hands-on experience in applying consumer laws to real-world business scenarios. Explore case studies and role-play exercises to develop practical skills for compliance and strategic planning. Case Studies: Discover how various businesses have successfully integrated consumer law principles into their operations. Analyze real-life examples to see how legal strategies have driven growth and mitigated risks. Networking Opportunities: Connect with fellow entrepreneurs, legal professionals, and industry experts. Share experiences, exchange ideas, and build connections that can support your business journey. Actionable Strategies: Learn actionable strategies for incorporating consumer law knowledge into your business plan. Get practical tips on how to use legal compliance as a competitive advantage and ensure long-term sustainability. Q&A Sessions: Engage directly with our panel of experts during dedicated Q&A sessions. Address your specific questions and get personalized advice on leveraging consumer laws for your business. Who Should Attend: This event is perfect for entrepreneurs, startup founders, business owners, legal advisors, and anyone interested in understanding how consumer laws can be used to build and scale profitable businesses. Whether you’re launching a new venture or seeking to optimize an existing one, this event will provide the insights you need to navigate legal complexities and foster financial success. Don’t miss this opportunity to harness the power of consumer laws to fuel your business growth. Register now and take the first step towards a more informed and legally sound business strategy!

3:00 pm - 3:20 pm

Personal & Business Tax Strategies

Laern the latest trend and strategies in personal & business tax.

3:20 pm - 3:35 pm

Break & Exhibit

Break & Exhibit Time

3:35 pm - 3:50 pm

Students Award Ceremony

Students Award Ceremony Time

3:50 pm - 4:20 pm

Credit Hero Stories ( Duaine Jhonson, Edwin Millard, Koy, Daveta, Joe, Andre) How has Joining CLSU Changed your Life and Income?

Listen to success stories of The Credit Hero (Daraine Delevante) and joining CLSU has changed the life and income for the better.

4:20 pm - 5:30 pm

Keynote Closing Remarks

That kicks off the second day of The Credit Summit, let's do a mild recap of all the things we learned and gathered.

DAY 3

8:00 am - 9:00 am

Registration & Coffee

Registration & Coffee Time

9:00 am - 9:20 am

Mindset Reset

David Powertalk will revitalize your mind one last time as you embark to your last leg of journey in The Credit Summit.

9:20 am - 9:50 am

Small Claims, Abritration, Superior or Federal Court

Explore the intricacies of legal dispute resolution at our comprehensive event, Small Claims, Arbitration, Superior or Federal Court. Designed for individuals, businesses, and legal professionals, this event will provide you with a deep understanding of the different avenues available for resolving disputes, from small claims courts to arbitration and higher courts.

9:50 am - 10:10 am

Grant Approval Secrets

Unlock the mysteries of securing funding with our exclusive event, Grant Approval Secrets. Tailored for nonprofit organizations, entrepreneurs, and grant seekers, this event is designed to demystify the grant application process and equip you with the strategies needed to successfully obtain grants for your projects. What to Expect: Expert Keynotes: Hear from grant-making professionals, experienced grant writers, and funding experts who will share their insider knowledge on what makes a grant application stand out. Learn from their successes and insights into the grant approval process. Successful Case Studies: Discover real-life examples of successful grant applications. Analyze how these projects navigated the grant process and what specific elements contributed to their success. Funding Strategies: Explore various strategies for identifying the right grant opportunities for your organization or project. Understand how to align your goals with funders’ priorities and leverage different types of grants effectively. Q&A Panels: Engage in interactive Q&A sessions with grant-making experts and successful grant recipients. Get answers to your specific questions about the grant process, from proposal writing to managing awarded funds. Who Should Attend: This event is ideal for nonprofit managers, project leaders, grant writers, and anyone involved in the grant application process. If you’re seeking to improve your grant-writing skills and increase your chances of securing funding, this event will provide you with the tools and insights you need. Don’t miss out on the opportunity to uncover the secrets to grant approval and enhance your funding success. Register today and take the first step toward achieving your project goals with the right financial support!

10:10 am - 10:30 am

Getting Approvals & Starting Your Funding Company

Are you ready to launch your own funding company but unsure where to begin? Join us for Getting Approvals & Starting Your Funding Company, a dynamic event designed to guide you through the essential steps of establishing and growing a successful funding business. This event is perfect for aspiring entrepreneurs, financial professionals, and anyone interested in the funding industry.

10:30 am - 11:00 am

Coffee Break

Coffee Break Time

11:10 am - 11:40 am

Child Support Is Fraud

I am giving you the step-by-step blueprint on How I Stopped Child Support Legally without an education in law. You'll learn how to get started, the affidavits I filed, mistakes I made and how I recovered, procedures and laws violated, what made it fraudulent, and how I proved it in court.

11:40 am - 12:00 pm

Build Your 7-Figure Community

Unlock the secrets to creating a thriving, profitable community at our exclusive event, Build Your 7-Figure Community. Join Candace Holyfield as she shares proven strategies for growing and monetizing a high-value community. Learn how to engage, nurture, and expand your audience to achieve seven-figure success. Don’t miss this opportunity to transform your community-building efforts into a powerful business asset. Start your journey towards building a thriving, seven-figure community!

12:00 pm - 1:00 pm

Lunch

Lunch Time

1:00 pm - 1:30 pm

Exhibition & Networking

See y'all there at our kiosks and booths where you could meet and greet and buy selected The Credit Summit merch.

1:30 pm - 2:15 pm

The Fight For Fair Credit

Live Audience podcast-style thorough discussion about The Fight For Fair Credit.

2:15 pm - 2:45 pm

Financial Planning To Never Go Broke Again

Discover the keys to financial stability and long-term success at Financial Planning To Never Go Broke Again. This essential event will provide you with actionable strategies for budgeting, saving, and investing wisely to ensure you never face financial hardship. Learn from Jacqueline Schadeck and gain practical insights to secure your financial future and build lasting wealth. Don’t miss this opportunity to take control of your finances and achieve financial security. Start your journey toward never going broke again!

2:45 pm - 3:30 pm

Finance & Marketing

Join us for an exclusive session with Marcus 500HIM Barney as he delves into the crucial intersection of finance and marketing at Finance & Marketing. Gain insights from Marcus 500HIM Barney on how to effectively integrate financial strategies with marketing efforts to drive growth and profitability. Don’t miss this opportunity to learn and enhance your business approach.

3:30 pm - 4:00 pm

Podcasting to grow your Brand & Business

Unlock the potential of podcasting to elevate your brand and expand your business at Podcasting to Grow Your Brand & Business. Join Brendan to explore effective strategies for creating and leveraging podcasts to reach and engage your target audience. Learn from industry experts how to craft compelling content, build a loyal following, and drive growth through the power of podcasting. Don’t miss this chance to turn your podcast into a powerful tool for brand and business success.

4:00 pm - 4:30 pm

Legal Shield - Personal & Business Affordable Legal Services

Join Alistair Edwards as he explores LegalShield - Personal & Business Affordable Legal Services. Discover how LegalShield provides accessible and cost-effective legal solutions for both personal and business needs. Alistair will guide you through the benefits of LegalShield's services, including comprehensive legal protection, expert advice, and document review, all tailored to fit various budgets. Whether you're an individual seeking peace of mind or a business owner needing reliable legal support, this event will offer valuable insights into how LegalShield can safeguard your interests without breaking the bank. Don’t miss this opportunity to learn how affordable legal services can benefit you.

4:30 pm - 5:00 pm

NEW CLSU Tech - The Future Of Consumer Law

Join Daraine as he launches the newest cutting edge technology in Credit Dispute.

5:00 pm - 5:30 pm

Closing Keynote

So, you're now financially empowered with the knowledge you'll ever need. Let's recap everything we've learned and gathered so far and listen to Daraine one last time as he wraps things up.

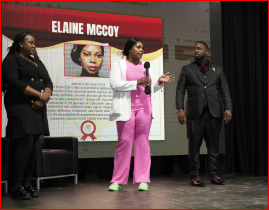

MEET THE SPEAKERS

EVENT SPEAKERS

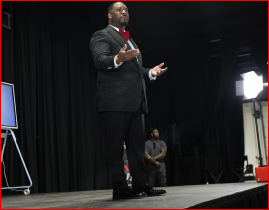

Daraine Delevante

Consumer Law Expert

About Daraine Delevante

Consumer Law Expert

I teach average and elite consumers how to repair, rebuild, and restore their credit using consumer laws. In just 6 months, my life was transformed after studying and applying consumer laws. That’s when I decided to dedicate my work and time to cultivating a culture of consumer law and a focus on credit repair– both professionally and personally, for all.

As an army veteran, I believe in service to the people. I believe consumers like you, should be armed with the knowledge and grit to employ the laws that were created to protect and serve them.

Some of My Results:

While stationed in the middle of the desert [ Kuwait] I built out an 800 credit score and a credible consumer profile. After leveraging my credit, I was able to rebuild an 800+ credit profile 3 times in less than 1 year, using consumer laws.

I will show you how to use consumer Law to DELETE any account from your consumer report. This is your chance to reclaim the control that is rightfully you

THEY SAY BAD CREDIT IS FOREVER, I SAY YOU CAN FIX IT!

Delete inquiries in 24 hrs

Delete Late Payments

Delete Accounts from Identity theft

Delete Child Support

Delete Bankruptcies

Delete Student Loans Charge Offs

Delete Mortgages

Delete Charge Offs

Delete Auto Loans

$997

V-VIP Pass

VVIP Welcome Packet

Access To Day 1 - Early Registration

Access To V-VIP Only Dinner - A NIGHT OF EXCELLENCE

V-VIP Preferred Seating

Access Day 1 Networking & Mixer Event

Access Day 2 & 3 Conference Sessions

Access to The Credit Summit FB Group

Networking with the Speakers

Meet & Greet - Take Photos with

Daraine Delevante

$497

VIP Pass

VIP Welcome Packet

Access To Day 1 - Early Registration

Access To VIP Only Dinner - A NIGHT

OF EXCELLENCE

VIP Preferred Seating

Access Day 1 Networking & Mixer Event

Access Day 2 & 3 Conference Sessions

Access The Credit Summit FB Group

Networking with the Speakers

Meet & Greet - Take Photos withDaraine Delevante

VVIP Swag Bags

$197

General Admission

Event Welcome Package

Access Day 1 Networking Mixture

Access Day 2 & 3 Conference Sessions

Access The Credit Summit FB Group

Access To Day 1 - Early Registration

Access To VIP Only Dinner - A NIGHT OF EXCELLENCE

VIP Preferred Seating

Networking with the Speakers

Meet & Greet - Take Photos withDaraine Delevante

VVIP Swag Bags

$97

Virtual Pass

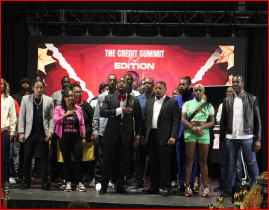

Gallery

See Our Family

Testimonials

Hear What People Are Saying

PAST SPEAKERS

LET’S DO IT HURRY!

HAVEN'T BOOKED YOUR SEAT YET?

GET YOUR TICKETS, NOW!

FAQ

What is the Credit Summit?

The Credit Summit is the nation’s leading conference designed for both consumers and credit repair professionals. It aims to bring together industry experts and individuals interested in learning about credit repair and management.

What can attendees expect from the Credit Summit?

Attendees can attend workshops and seminars on a variety of topics related to credit repair and management. They will gain knowledge and tools to improve their credit scores, understand their credit reports, and take control of their financial futures. Credit professionals can network with peers, exchange ideas, and learn about the latest trends and best practices in the industry.

What topics will be covered at the Credit Summit?

The Summit will cover various topics, including how to delete negative items from credit reports like bankruptcies, late payments, charge-offs, inquiries, student loans, collections, and more.

How long is the Credit Summit?

The Credit Summit is a three-day event.

How much are tickets to the Credit Summit?

There are various pricing tiers: Tickets price at Virtual Pass $97, General Admission Pass for $197, VIP Pass $497, and VVIP Pass $997.

Can I attend the Credit Summit virtually?

Yes, there is a virtual pass option available for $97.

Where is the Credit Summit located?

The event will be held at Atlanta Marriott Buckhead Hotel & Conference Center in Atlanta, Georgia.

Is the Credit Summit beneficial for credit professionals?

Yes, credit professionals have the opportunity to network with one another, exchange ideas, and learn about the latest trends and best practices in the industry.